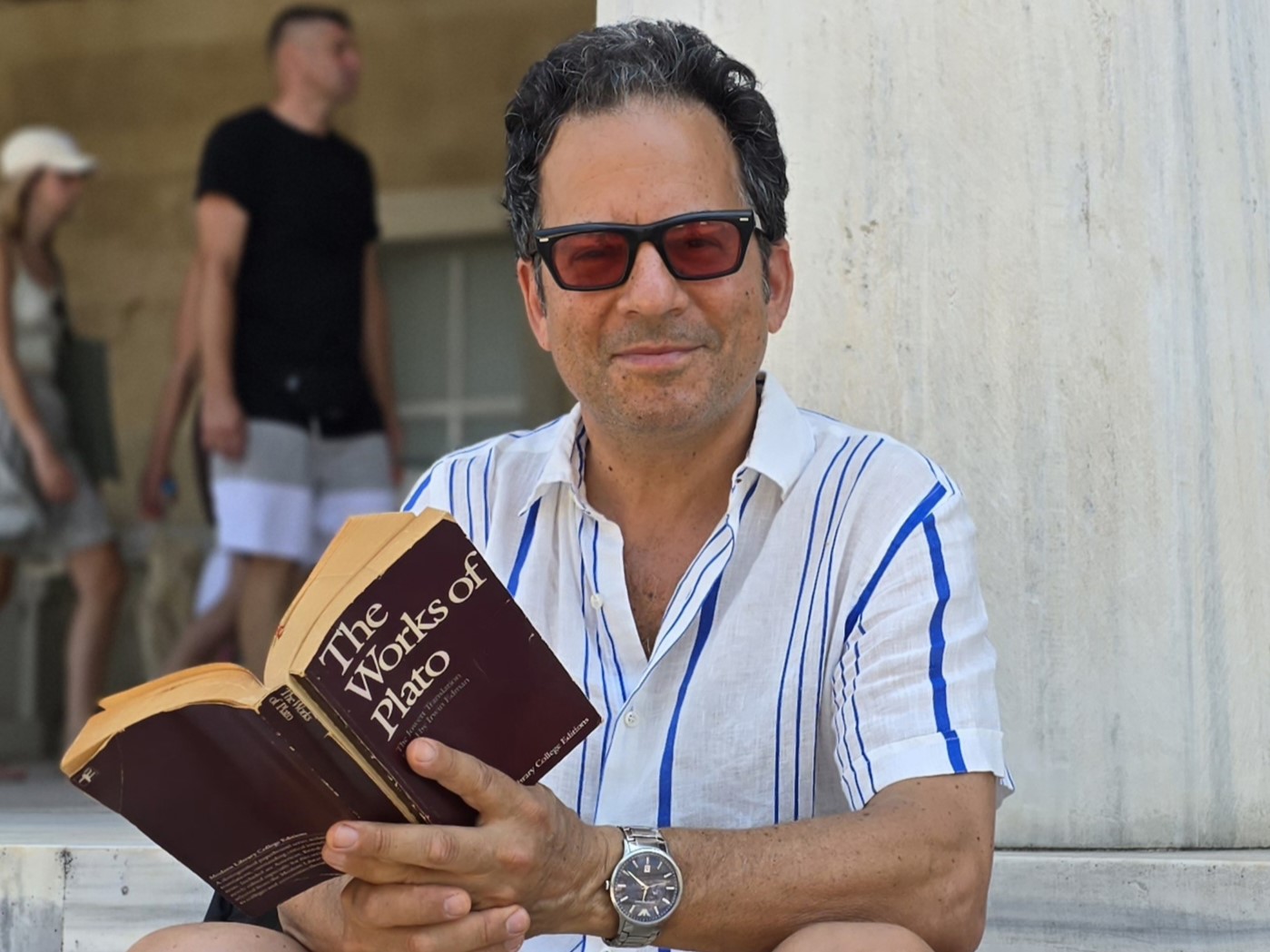

Max Grossman: Guest columnist, Published 7:01 a.m. MT Aug. 15, 2024

Our city and county have adopted opposite approaches to borrowing and taxation. While the mayor and majority of City Council are committed to fiscal restraint and administrative efficiency, the County Commissioners Court has authorized hundreds of millions in bonds, raised taxes, and voted themselves double-digit salary increases.

On Jan. 3, 2023, three new city representatives wore sworn in — Brian Kennedy, Art Fierro, and Chris Canales —changing the balance of power on council and catalyzing a radical reassessment of policy priorities. The same day they began their terms, the project to build a multipurpose arena in Duranguito was suspended. Less than two months later, they terminated City Manager Tommy Gonzalez without cause, ending an eight-year reign that saw an unprecedented spate of borrowing, huge cost overruns on the Quality of Life Bond projects, and a painful series of tax increases, as our streets fell into disrepair.

In spite of large investment in capital improvement projects and generous incentives for private corporations, our city population declined by about 6,000 residents between 2017 and 2023, the first decrease since 1932. Some attribute this demographic shift to a lack of high-paying jobs and the so-called brain-drain, but anyone who pays property tax knows the primary reason: our ever-increasing tax burden. I have lost track of how many of my neighbors moved to New Mexico, though they work in Texas.

As a result of the city’s multiyear spending binge, the current City Council inherited $2.3 billion in bonded indebtedness, including $852 million in principal and interest on 10 certificates of obligation, pressuring their budgets. Nevertheless, Interim City Manager Cary Westin and CFO Robert Cortinas, with strong direction from Mayor Oscar Leeser and Reps. Kennedy, Molinar, and Fierro, succeeded in achieving a no-new-revenue tax rate for two consecutive fiscal years and without issuing a single dollar of bond debt. In addition, the City terminated TRZ 2 and TIRZ 10A, saving $9.2 million annually, eliminated two deputy city manager positions and paired down the executive staff, and shrank departmental units without diminishing core city services. The Financial Oversight and Audit Committee, chaired by Kennedy, wasted no time in auditing the city gas cards, P-cards, and 380 agreements with developers, correcting a torrent of abuses.

Meanwhile, the county is on an entirely different path. In a series of votes on Monday, the Commissioners Court authorized a vote on the largest property tax increase in modern memory. They voted to place a $396.6 million general obligation bond on the Nov. 5 ballot for University Medical Center that would increase our property tax by 4.5 cents per $100 of valuation. Minutes later, they voted to place $323.8 million in additional general obligation bonds on the same ballot, organized into five ballot propositions, potentially adding another 3.0 cents to our tax. The proposed spending includes $105.5 million for the County Coliseum and $95.6 million in improvements for 13 parks. Minutes after that, they proposed increasing the county tax rate by 5.2 cents, to the voter-approval rate (just as they did last year). We also know that the county, sometime before the election, is planning to issue a certificate of obligation of approximately $174 million, the largest in the history of our community.

If the voters approve all these bonds and the county issues its CO and adopts its proposed tax rate, the taxpayers will assume about $894 million in new debt, resulting in more than $1.5 billion in additional debt servicing. The total tax increase will be a jaw-dropping 12.7 cents, amounting to $254 for a home assessed at $200,000.

To add insult to injury, last year the commissioners voted themselves a 16.2% pay raise, coming on the heels of a 42.4% raise in 2016 and 22.6% in 2020. There are two sitting commissioners who more than doubled their own salaries since assuming office.

Thus, while the city restrains spending and provides El Pasoans with much-needed tax relief, the county has begun a spending spree for the record books, with only Commissioner Iliana Holguin pushing back. As a consequence, El Pasoans will likely bear an even higher tax burden in 2025, forcing more residents out of their homes, especially retirees, and further suppressing business investment.

In this election cycle, voters should support fiscally responsible candidates for local office, such as Brian Kennedy for Mayor and Ryan Woodcraft for County Precinct 1, and they should beware of politicians, like Renard Johnson and Jackie Butler, who advocate for more investment, tell us that we deserve more amenities, or complain that our current leadership lacks vision. All of that deceptive jargon simply means more borrowing and higher taxation.

In the long term, the leaders of our local taxing entities must come together and mutually agree on a financial strategy that will lower our property tax with the aim of making our community friendlier to homeowners and investors.

Max Grossman is an architectural historian.