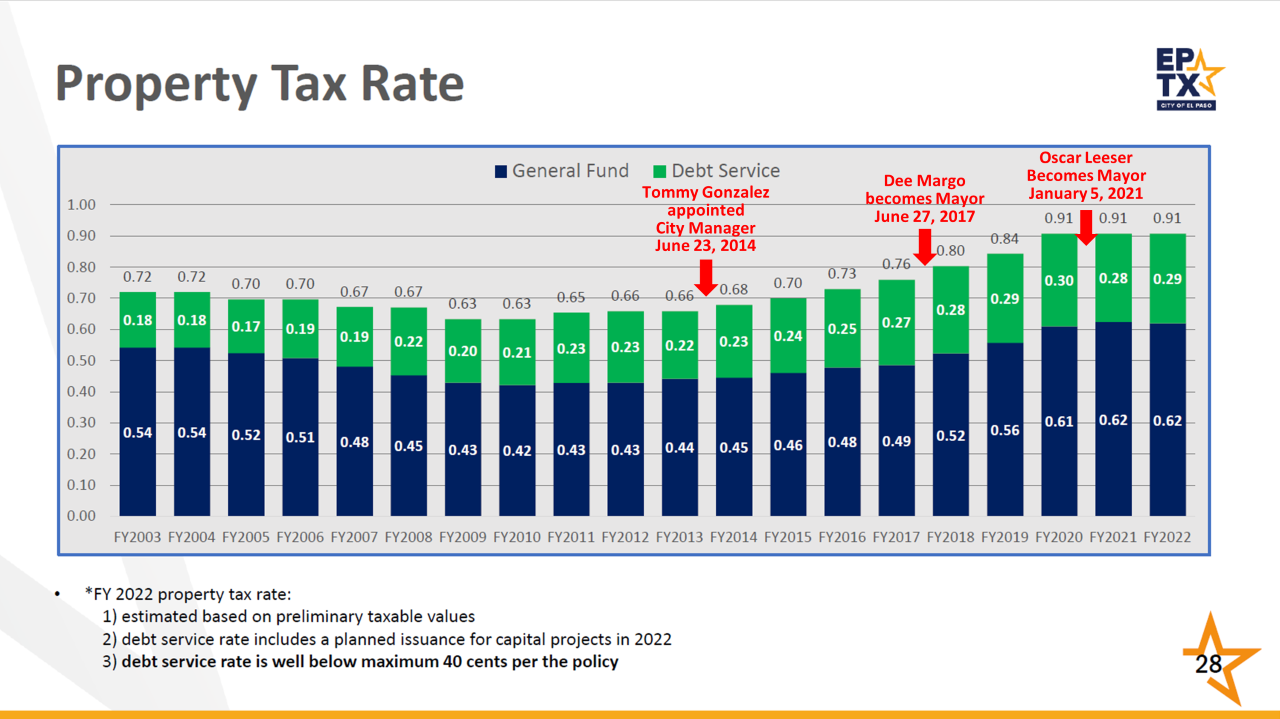

Last month our City Council voted unanimously to order City Manager Tommy Gonzalez to craft a plan to decrease the City property tax rate, which has risen 38% since Gonzalez was appointed on June 23, 2014.

Every El Pasoan who owns property understands the utter hypocrisy of this vote!

Let us remember that six out of eight members of City Council voted to increase our property tax rate, with Reps. Svarzbein, Annello and Hernandez voting to do so three times! (see below) And yes, Gonzalez and the CFO had a lot to do with those increases.

Let us also remember that Reps. Svarzbein, Hernandez, Salcido and Rivera voted to authorize more than $500,000,000 in certificates of obligation without voter approval, with Reps. Annello and Lizarraga not far behind, putting upward pressure on our taxes.

Let us also remember that five current members of City Council (Svarzbein, Hernandez, Salcido, Rivera, and Lizarraga) voted to create TIRZ 13, the largest corporate handout in El Paso history, effectively denying the City hundreds of millions of dollars in future property tax revenue.

Do I need to remind you also about the galaxy of other incentives and giveaways to developers that help ensure that El Paso homeowners, rather than the commercial sector, will always bear the brunt of our property tax burden?

Of the big tax-and-spend members of City Council, Reps. Salcido and Lizarraga–both committed members of the Oligarchy Caucus–are up for reelection this November and will have to explain to their constituents why we have the second highest property tax rate among the 50 largest cities in America and why the big developers get huge tax breaks while the common folk are expected to pay 100% of their tax bill.

Good luck with that.

Max

CITY COUNCIL PROPERTY TAX VOTES

SVARZBEIN, District 1, 7/6/15-present

8/18/2015 Increase City property tax from $0.699784 to $0.729725 NO

8/23/2016 Increase City property tax from $0.729725 to $0.759656 YES

8/22/2017 Increase City property tax from $0.759656 to $0.803433 YES

8/21/2018 Increase City property tax from $0.803433 to $0.843332 NO

8/20/2019 Increase City property tax from $0.843332 to $0.907301 YES

8/18/2020 Keep City property tax at $0.907301 YES

8/24/2021 Keep City Property tax at $0.907301 YES

ANNELLO, District 2, 6/27/2017-present

8/22/2017 Increase City property tax from $0.759656 to $0.803433 YES

8/21/2018 Increase City property tax from $0.803433 to $0.843332 YES

8/20/2019 Increase City property tax from $0.843332 to $0.907301 YES

8/18/2020 Keep City property tax at $0.907301 YES

8/24/2021 Keep City Property tax at $0.907301 YES

HERNANDEZ, District 3, 6/27/2017-present

8/22/2017 Increase City property tax from $0.759656 to $0.803433 YES

8/21/2018 Increase City property tax from $0.803433 to $0.843332 YES

8/20/2019 Increase City property tax from $0.843332 to $0.907301 YES

8/18/2020 Keep City property tax at $0.907301 YES

8/24/2021 Keep City Property tax at $0.907301 YES

MOLINAR, District 4, 1/5/2021-present

8/24/2021 Keep City Property tax at $0.907301 NO

SALCIDO, District 5, 1/8/2019-present

8/20/2019 Increase City property tax from $0.843332 to $0.907301 YES

8/18/2020 Keep City property tax at $0.907301 YES

8/24/2021 Keep City Property tax at $0.907301 YES

RODRIGUEZ, District 6, 2/17/2020-present

8/18/2020 Maintain City property tax at $0.907301 ABSENT

8/24/2021 Keep City Property tax at $0.907301 YES

RIVERA, District 7, 6/27/2017-present

8/22/2017 Increase City property tax from $0.759656 to $0.803433 YES

8/21/2018 Increase City property tax from $0.803433 to $0.843332 YES

8/20/2019 Increase City property tax from $0.843332 to $0.907301 NO

8/18/2020 Keep City property tax at $0.907301 YES

8/24/2021 Keep City Property tax at $0.907301 YES

LIZARRAGA, District 8, 7/25/2017-present

8/22/2017 Increase City property tax from $0.759656 to $0.803433 YES

8/21/2018 Increase City property tax from $0.803433 to $0.843332 YES

8/20/2019 Increase City property tax from $0.843332 to $0.907301 YES

8/18/2020 Keep City property tax at $0.907301 YES

8/24/2021 Keep City Property tax at $0.907301 YES