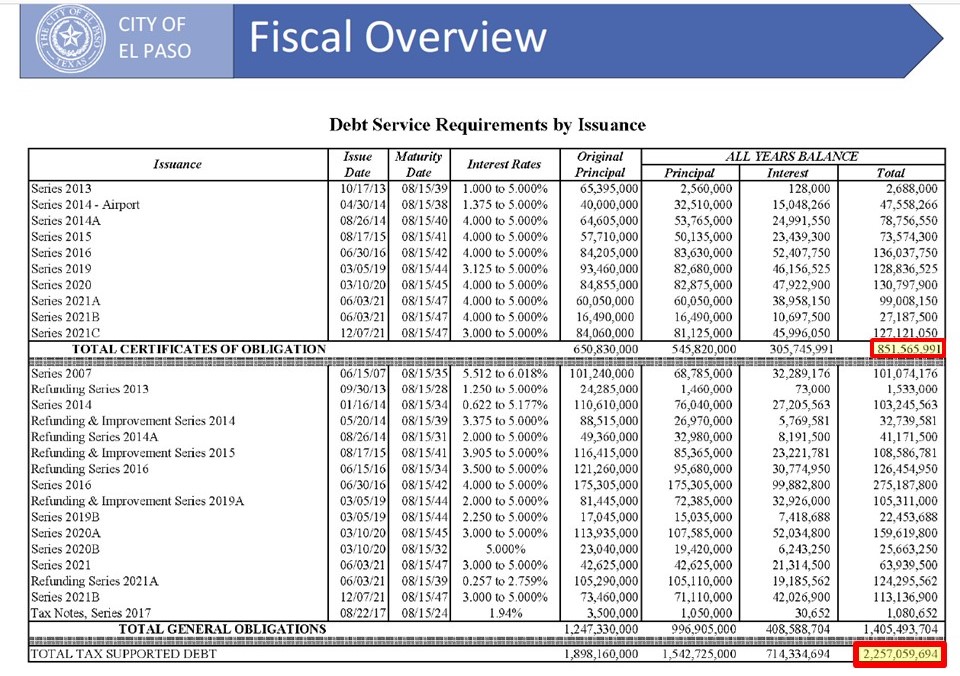

The City’s latest debt figures are available on page 79 of the FY 2023 Budget Book, posted to the webpage of the Office of Budget & Management.

There you will find that our City owes $851,565,991 in principle and interest on 10 certificates of obligation that have been issued since 2013. That represents 37.7% of the City’s total bonded indebtedness of $2,257,059,694 (up from 35.7% the year before).

And the City has not even issued all the CO debt that has been authorized by City Council. We are set to borrow tens of millions more!

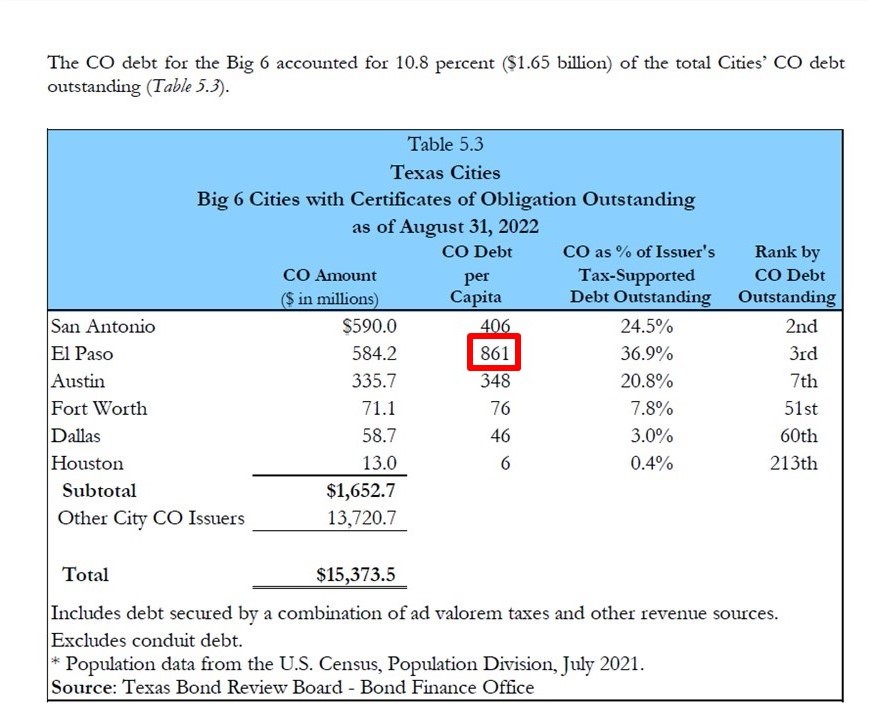

The Texas Bond Review Board recently published its statistics on local government debt for 2022. In Table 5.3 we see that, as of 2022, El Paso had $861 of CO debt per capita.

The CO debt per capita of the five largest Texas cities can be calculated by dividing their combined CO debt ($1,068,500,000) by their combined population (7,154,778). That figure is $149.34 per capita.

Thus, at $861 for every resident, El Paso, which is the sixth largest Texas city, has 5.8 times more CO debt per capita than the CO debt per capita of the five largest Texas cities!

The vast majority of our massive CO debt was issued during the tenure of City Manager Tommy Gonzalez, who brags about his balanced budgets and fiscal discipline, even though his entire financial strategy relies upon huge debt issuances without voter approval.

But his strategy also relies upon property tax hikes. In fact, our net property tax burden has increased every single year for eight years in a row, since Gonzalez assumed office in 2014.

Gonzalez will say that he is simply doing what he must to finance the priorities of City Council, but we are not that stupid. He has been promoting and pumping the agenda and pet projects of the Oligarchs since the day he entered City Hall.

So far our City has managed to maintain its high bond ratings. Fitch gave the last City CO, Series 2021C, a AA rating. But given our exploding debt load and the fact that our municipal population is dwindling, it seems all but certain that we will face bond rating downgrades in the future, with dire consequences.

In conclusion, Tommy Gonzalez and his staff, with City Council authorization, have taken El Paso on a path to insolvency. They have approved huge debt issuances without voter approval while raising our property tax repeatedly.

The good news is that City Council now includes representatives who are deeply concerned about Gonzalez’s fiscal policies.

We shall see if their concern translates into legislative action.

Max