*NOTE: THIS REPORT FOCUSES ON THE PROPERTY TAX RATE BUT DOES NOT CONSIDER THE NO-NEW-REVENUE TAX RATE

Dear Friends,

Since 2014, our City property tax rate has increased 38%, from $0.66 per $100 of valuation to $0.91.

The tax rate stood at $0.76 when Dee Margo was sworn in as Mayor on June 27, 2017 after promising to “hold the line on taxes,” so most of the increase occurred under his watch.

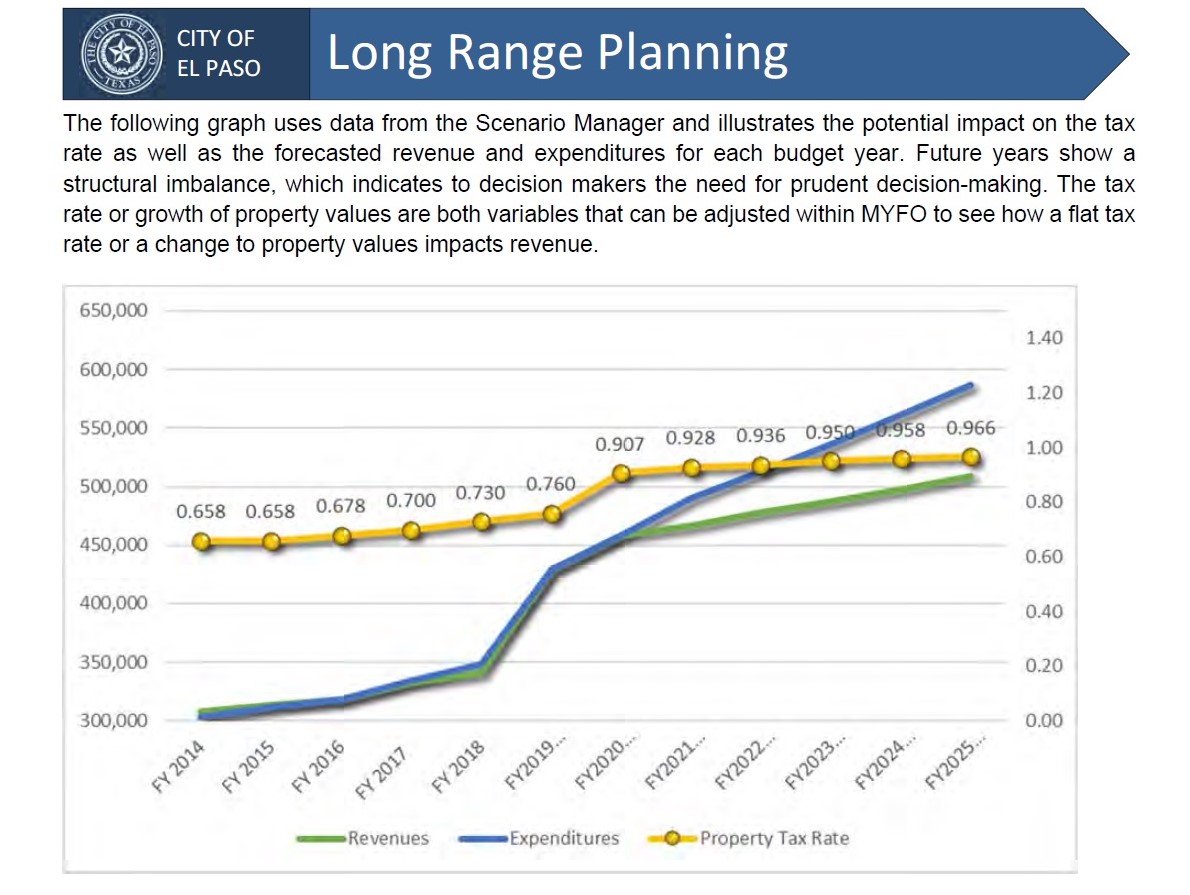

I have attached a key chart from page 348 of the City of El Paso FY 2020 Budget Book. It predicts that our City property tax will rise to $0.97. However, in order for the tax rate to keep up with tax-supported expenditures, the chart shows it would need to be increased beyond $1.20 to keep up!

Below is my email from December 18 in which I document the City’s plan to raise the debt-servicing portion of our property tax by 33% by 2026, which means, of course, that our overall City tax rate will rise by the same proportion, taking us to approximately $1.21 (corroborating the attached City chart).

Thus, we can conservatively estimate that our overall City property tax rate will peak at approximately $1.21 in 2026, meaning that it will be 33% more than this year, and 83% higher than when Tommy Gonzalez was appointed City Manager!

Why have our taxes increased so dramatically while our population remains flat? Who is benefiting from the City’s explosive increase in spending? If El Paso files for bankruptcy, who will be held responsible?

More importantly, why have our local media failed to report these figures, which are in plain sight?

Quite honestly, I believe that City Manager Gonzalez and CFO Robert Cortinas are practical men who wish to contain taxation and spending. That is what they are trained to do, and their recent statements to City Council reveal genuine concern about the budget. But I am convinced they are being thwarted by the agenda of Mayor Margo, Rep. Peter Svarzbein, and their powerful campaign contributors, who insist on reckless spending.

Reps. Annello and Rodriguez need to direct City Staff to present more comprehensive information on where our tax rate is going and how to contain it.

Enjoy your day!

Max

—————————————————————-From: Max Grossman <maxelijah@hotmail.com>

Sent: Wednesday, December 18, 2019 11:38 AM

Subject: ALERT: CITY DEBT SERVICE TO RISE 33% BY 2026!

Dear Media and Friends:

PLEASE PAY CLOSE ATTENTION!

On November 19, a City committee you’ve never heard of called the “Financial Oversight and Audit Committee” (FOAC) convened in City Hall. Agenda item 3 called for discussion and action on a proposed revision to the City of El Paso’s Debt Policy. City CFO Robert Cortinas made a presentation with a PowerPoint (attached to the agenda item) revealing that the City plans to raise the debt servicing portion of our property taxes by 33% over the next seven years! I have integrated the new information into the attached chart, which is my modification of a document that Cortinas presented to City Council a couple years ago.

You see, the City portion of our property tax funds two things: M & O (Management and Operations) and Debt Service. When Tommy Gonzalez was appointed City Manager on June 23, 2014, the City assessed a total tax of $0.66 per every $100 of property valuation. When Dee Margo was elected Mayor on May 6, 2017, the tax had risen to $0.76. Thanks in large part to Gonzalez and Margo, our tax now stands at $0.91, an increase of 38% since June 2014.

The Debt Service portion of the tax increased from $0.22 when Gonzalez was appointed to $0.30 today. Now we learn that the City plans to increase our Debt service incrementally each year until it peaks at $0.40 in 2026!

The City refuses to release the M & O projections, so we do not yet know precisely what our total City property tax is going to be in 2026. But since the M & O tax rate has historically increased at a slightly faster rate than the Debt Service tax rate, we can conservatively estimate that our overall City property tax rate will peak at approximately $1.21 in 2026, meaning that it will have increased 83% since Tommy Gonzalez came to power! Thus, whereas the City property tax on a $150,000 home before Tommy Gonzalez was $990 per year, in 2026 the tax owed will be approximately $1,815 per year, and that is before any reassessment of home values by the Central Appraisal District! Please keep in mind that today, in 2019, El Paso already has the second highest homestead tax among the 50 largest cities in America, just behind Detroit.

HOW DID THIS HAPPEN?

During the November 19 presentation, Cortinas recommended raising the maximum debt service tax rate from $0.35 to $0.40. According to him, the tax needed to be raised in order to finance all the City’s remaining unissued debt. He cites specifically the financial pressure from the $413 million Public Safety Bond, $140 million of unissued Quality of Life bond debt, $80 million for 2012 street projects, and the Capital Plans for 2017, 2018, and 2019–somewhere between half a billion and a billion dollars in future debt obligations.

The FOAC consists of four City Council Reps: Morgan (D4), Ordaz Perez (D6), and Rivera (D7), Lizarraga (D8). Ordaz Perez, who is up for election, was conveniently absent on November 19. The motion to bring the matter for a vote before City Council passed 3-0 with very little discussion at all and no substantive questions. See the video here. Notably, no one bothered to asked Cortinas how the change would effect total property tax rates going forward.

Next, a Work Session was held for CIty Council on Monday, December 9, during which the City Council reps were presented with the formal report of the FOAC meeting of November 19. No video is available for that meeting and the minutes have not been published.

Finally, on December 10, the matter was brought to City Council for discussion and action under agenda item 17.2. Cortinas made the same presentation to City Council that he had made to the FOAC the month before, but this time he cited only the Public Safety Bond as a contributing factor to the tax increase and totally omitted the effects of the QOL bond and other projects. In the City Council video, the chart showing the debt service tax rate increasing to $.040 in 2026 is blurry and illegible. After only 3 minutes and 55 seconds of discussion, during which not one rep asked anything about the effect of the item on overall tax rates, the Mayor interrupted with “Are we ready to vote?” and the item passed unanimously 8-0.

Why have our taxes increased so dramatically while our population remains nearly flat? Who is benefiting from the City’s explosive increase in spending? If El Paso files for bankruptcy, who will be held responsible?

With each passing day, our City looks more and more like a criminal enterprise.

Max