The same folks who long insisted that the taxpayers build an arena with a minimum capacity of 14,000 seats are now demanding that City Council seek private investors to help pay for it.

The City has $162 million remaining from the 2012 Quality of Life Bond, plus future proceeds from selling the properties it owns within the former Arena Footprint.

In January 2023, the City’s own consultants determined that a 14,000-seat facility would cost approximately $483 million. Adjusted for inflation, that would be more than $500 million today.

During the regime of former Mayor Dee Margo, the plan was to meet the $300 million shortfall by issuing certificates of obligation without voter approval. But Margo was ejected from office by the voters and replaced by Mayor Oscar Leeser, who vowed to oppose CO issuances for QOL bond projects.

On January 3 last year, an anti-boondoggle coalition took over City Council, leaving Rep. Cassandra Hernandez and her morally bankrupt colleagues in the minority and shutting down most of the Oligarchy agenda.

Lately, the City has been toying with the idea of building a much smaller facility with the remaining bond funds adjacent to the Union Depot, and within budget.

As a consequence, several of the big developers and their allies have been whining and howling that the proposed project would be a failure, with former City Manager Joyce Wilson calling it a “pea-brain vision.”

Vic Kolenc of the El Paso Times recently interviewed Joe Gudenrath, Executive Director of the Downtown Management District, Leonard “Tripper” Goodman, former President and CEO of Goodman Financial Group, and attorney and hotel owner Jim Scherr.

Gudenrath told Kolenc that the City should seek private partners to help pay for a large arena, but according to Kolenc he “doesn’t know who the other partners would be.”

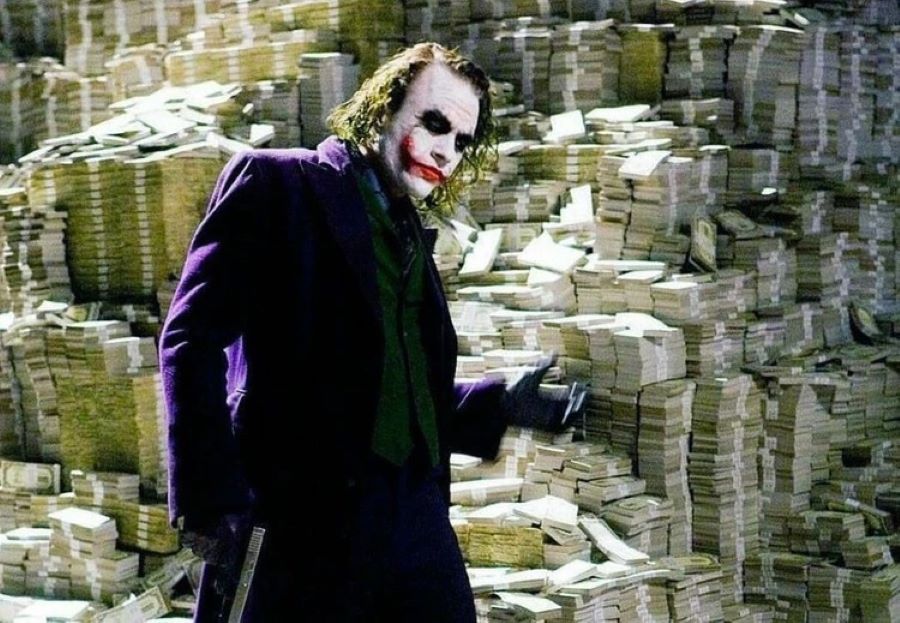

Does it strike anyone as strange that more than 11 years after the bond election, not a single private investor has stepped forward to contribute funds? That is because the project would hemorrhage even more money than the Ballpark, which requires an annual $4.2 million subsidy to stay afloat.

You see, the Oligarchs have been used to receiving corporate welfare on an industrial scale, and the arena, which never had private support or any kind of business plan, would have been the mother of all money-losers.

Goodman, who led a PAC promoting the QOL bond back in 2012, insisted that the original project envisioned an arena of 14,000 to 15,000 seats.

Of course, the ballot never stated that the plan was for a G-League basketball arena or that it would be dropped like a bomb atop the oldest neighborhood in Downtown, and no one revealed that the project was terribly underfunded.

My attorneys had fun cross-examining Goodman under oath in 2017, when he told a judge in Austin that everyone knew the facility was going to be for sports, but when presented with pro-arena marketing advertisements produced and disseminated under his authority in 2012, he was forced to admit that not one of them cited sports.

And then there is Jim Scherr, who famously received a generous taxpayer-funded 380 incentive agreement for his DoubleTree Hotel next to Interstate 10. He told Kolenc, “We wanted sports, we wanted entertainment, and we wanted something to supplement the convention center.”

Who is “we”? Obviously, that would be the private downtown investors who wanted public bond funds spent for a facility that would serve their private interests, even though it meant using eminent domain and displacing scores of tenement residents.

Scherr has been practicing law for 48 years, so we are surprised he did not examine the 2012 QOL bond ordinance, which states that the facility shall be “for permanent public improvements and public purposes.”

We are also surprised by his ignorance of Title 9, Subtitle E, Chapter 1331 of Texas law, which stipulates that home-rule municipalities like El Paso may only expend public bond funds for a public purpose.

But why let the law, private property rights, and the plight of the poor get in the way of Leonard “Tripper” Goodman, Jim Scherr, and their friends?

Now that their bid to fleece the taxpayers has been foiled, they are welcome to gather their investor friends from the local country clubs and raise a few hundred million for fund their project and assume all the capital risk.

Any takers?