Yesterday Vic Kolenc of the El Paso Times published a report in which he calculates that the proposed UMC debt issuance, now stated to be $346 million, will add $80 per year to the property tax bill of a $146,000 home, which is the County average.

So far, Commissioner Iliana Holguin of Precinct 3 is the only one in the County insisting that the issuance should take the form of a general obligation bond rather than a certificate of obligation and that it should be placed on the November 8 ballot.

I sincerely hope that County Judge Samaniego and the other three Commissioners will join Holguin when this comes up for discussion again on June 27.

CITY TO VOTE ON PLACING $399 MILLION BOND ON NOVEMBER BALLOT!

At Monday’s City “Work Session” under agenda item 9, the City will brag about lowering our City property tax rate, which was 65.8 cents per $100 of valuation when Tommy Gonzalez assumed office in June 2014, from the current $90.7 cents to 90.0 cents in FY 2023.

Woopty-doo!

I guess the City incumbents who voted to raise our taxes will try to campaign on this tiny reduction of seven-tenths of one cent. 🤣

Then, at Tuesday’s City Council meeting the City will vote on issuing a “Community Progress Bond” in the amount of $399 million! What, you don’t believe me? It’s item 36 on the agenda with the figure reported on page 5 of the PowerPoint.

I propose renaming the issuance the “Community Progress Toward Insolvency Bond.”

70% of this will go to streets, 29% to parks and recreation, and 1% to climate change.

You see, the City cannot pay for these things from the General Fund because (1) the General Fund is insufficient given the City’s spending priorities, and (2) the City has denied itself untold millions in revenue because of the TIRZes, 380 agreements and other incentives it has doled out to the Oligarchs.

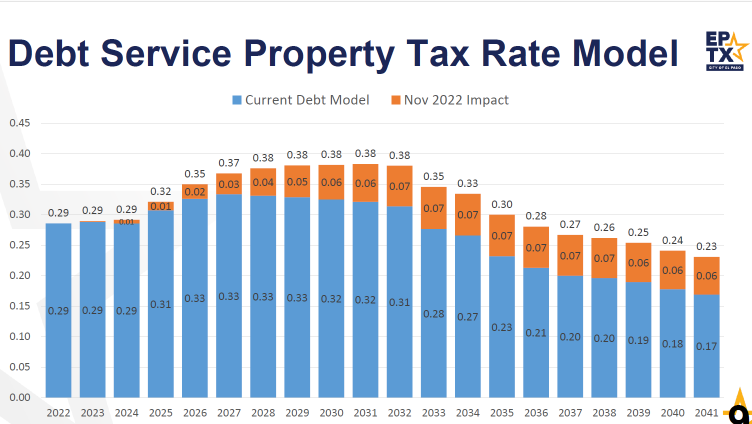

In the same presentation, the City will show the attached chart, which is on page 9. The chart indicates that the debt service portion of our property tax rate is 29 cents currently, rising to 33 cents in 2026. The chart also shows the impact of the proposed Community Progress Toward Insolvency Bond in orange, which will incrementally add 7 cents to our City property tax by 2032.

Thus, assuming no change in our General Fund tax rate going forward–and that is a major assumption–by 2026 our total City tax rate would rise to approximately 96 cents by 2026 and 99 cents by 2028!

AVERAGE HOMEOWNER TO PAY AT LEAST $172 MORE IN PROPERTY TAX BY 2028

In summary, the $346 million UMC debt issuance would add $80 to the average property tax bill and, within six years, the $399 million City Community Progress Toward Insolvency Bond would add at least $92, for a total of $172 for a $146,000 home. These figures are based on current interest rates, which are rising each week, and so we will likely pay even more.

And we do not yet know whether the school districts and EPCC are also planning new bond issuances and/or rate hikes.

We already have the second highest residential property tax rate among the 50 largest American cities, but with this new debt burden we could potentially surpass Detroit and become number one.

I guess for some politicians that is “community progress.”