*NOTE: This report is flawed because we do not where the tax rate stands in relation to the no-new-revenue tax rate.

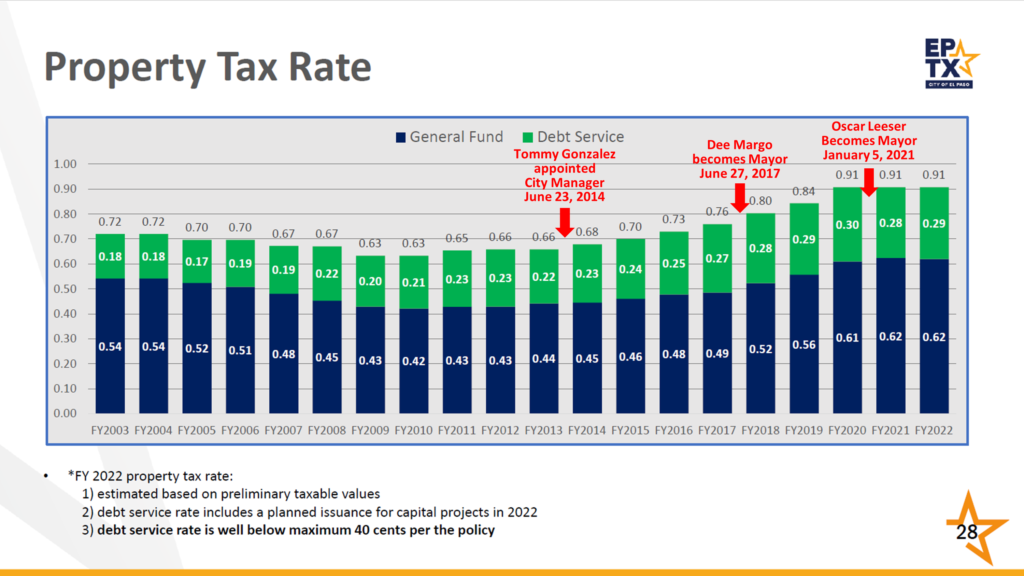

Tommy Gonzalez was appointed City Manager on June 23, 2014, and since that time the City portion of our property tax has rate increased by 38%, from $0.66 to $0.91 per $100 of valuation. See the attached chart from the last City Council meeting.

Yet, between 2014 and 2020, the City population increased only 1%, from 679,024 to 685,434.

How can our City government possibly justify increasing our property tax rate by 38% over seven years when our population barely increased during the same period?

It would be nice if our local media asked that basic question of those elected leaders who have voted for every single tax rate increase during their terms. In all fairness to Gonzalez, he is charged with finding ways to pay for all the crap coming out of City Council, which is run mostly by people with little or no financial acumen.

Of course, Mayor Leeser does have financial acumen, and we all look forward to seeing him advocate for El Paso taxpayers as he promised.

Rep. Molinar and Rep. Rodriguez were the only two on City Council to vote against borrowing $93M in the form of certificates of obligation, which do not require voter approval. Just think, the structure of the Ballpark cost $64M to build, but City Council just borrowed 45% more than that in a single stroke! At least we have two reps who are on our side when it comes to taxation and spending.

I was able to look up the 2012 tax rates of the five taxing entities that comprise the total property tax bill for El Pasoans in my neighborhood, and I compared that to 2021.

In 2012, the City accounted for 25% of our total property tax burden, but today it accounts for 29%.

Taxing entity 2012 2021 % change

—————————————————————————

CITY OF EL PASO 0.658404 0.907301 +37.8%

EL PASO COUNTY 0.408870 0.488997 +19.6%

EL PASO I.S.D. 1.235000 1.318350 +6.7%

EPCC 0.114086 0.139859 +22.6%

UNIV MED CTR 0.192363 0.267747 +39.1%

—————————————————————————

TOTAL TAX RATE 2.61% 3.12% +19.5%

Recently the City announced that it will not raise its property tax rate, as if we should be grateful for that!

I’ve said it before and I’ll say it again. At 3.12%, El Paso has the second highest homestead tax rate among the 50 largest cities in the United States and we should be mad as hell at the elected representatives who have blown up their budgets in order to satisfy the demands of a small number of elite families while ramming through boutique projects, which lie far outside the proper role and scope of government, that we are constantly told we “deserve.”

Today a group of El Pasoans protested their property valuations in front of the Central Appraisal District Office, and I have attached a photo, courtesy of my friend Ben Carnevale.

But they are protesting at the wrong place! They should be protesting in front of the offices of the five taxing entities that have raised our tax rates in spite of our stagnant population growth.

Enjoy your evening.