David Crowder of the El Paso Inc published a report in which he analyzed a PowerPoint presented by City CFO Robert Cortinas–yes, the same CFO who recently told me that he is undisturbed by our level of municipal CO debt, the highest in the history of Texas.

City Council will convene tomorrow morning at 9:00am, and under agenda item 44 they will host a “Public Hearing on the Proposed Budget, as amended, for the City of El Paso, filed by the City Manager with the City Clerk on July 15, 2021, which begins on September 1, 2021 and ends on August 31, 2022.”

That should include a discussion of the $476 million General Fund budget, which is the portion of our $1.06 billion City budget that is supported by property and sales taxes.

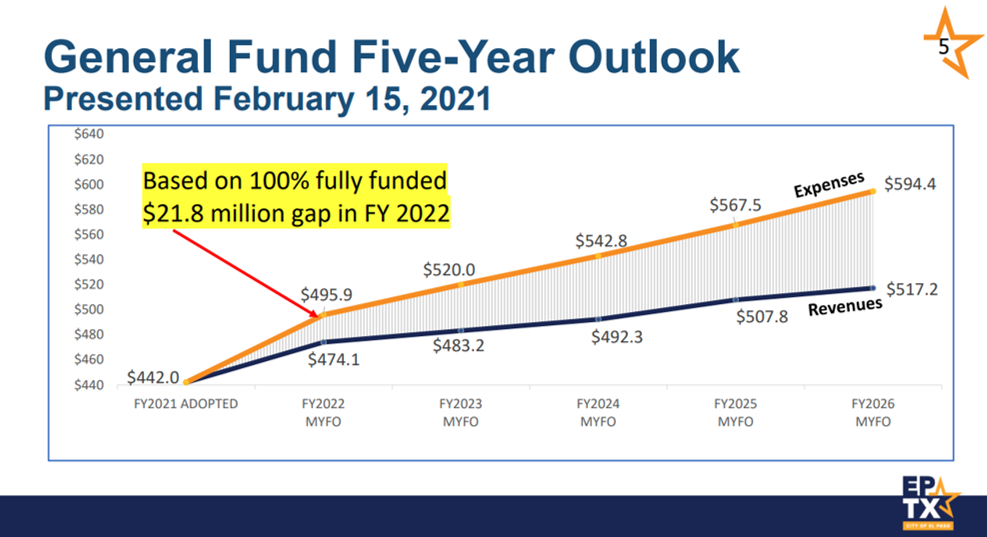

The attached slide from the PowerPoint shows that in FY 2022 our the General Fund revenue shortfall will be $22 million. That gap will widen to $37 million in FY 2023, $51 million in FY 2024, and $60 million in FY 2025.

You see, our rapidly rising property tax cannot even keep up with the City’s reckless deficit spending.

The tax rate will remain $0.91 per $100 of valuation, an increase of 38% since Tommy Gonzalez became City Manager in 2014. Yet according to Crowder, the City’s tax on the average home will now increase by 6.6%.

Thus El Paso homeowners will face yet another painful tax increase.

All that said, a major question looms: How will our City property tax rate be impacted by the $189 million in CO debt that our City Council voted to issue since April, without voter authorization?

Mr. Cortinas may need to revise his chart accordingly…

Enjoy your evening.