WHAT IS A TAX INCREMENT REINVESTMENT ZONE?

The Tax Increment Financing Act is in Chapter 311 of the Texas Tax Code.

According to the Texas Comptroller, tax increment financing is a “method local governments can use to pay for improvements that will draw private investment to an area. Tax increment financing isn’t a new tax; instead, it redirects some of the ad valorem tax from property in a geographic area designated as a Tax Increment Reinvestment Zone (TIRZ) to pay for improvements in the zone. Tax Code Chapter 311 governs tax increment financing.

Future tax revenues from each participating taxing unit that levies taxes against a property are used to pay for the cost of improvements to an area. Each taxing unit may dedicate all, a portion of, or none of the tax revenue that is attributable to increased property values brought about by improvements within the reinvestment zone. The additional tax revenue received from the affected properties is referred to as the tax increment. Each taxing unit determines what percentage of its tax increment, if any, it will commit to repayment of the cost of financing the public improvements.

Only a city or county may initiate tax increment financing. Tax increment financing requires the governing body of a city to create a Tax Increment Reinvestment Zone (TIRZ). The governing body of a city by ordinance may: designate a contiguous or noncontiguous geographic area (a) within the corporate limits of a municipality; (b) in the extraterritorial jurisdiction of the municipality, or (c) in both to be a reinvestment zone. The designation of an area that is wholly or partly located in the extraterritorial jurisdiction of a municipality is not affected by a subsequent annexation of real property in the reinvestment zone by the municipality.

Once a city begins the process of establishing a tax increment financing reinvestment zone, other taxing units may consider participating in the zone.”

EL PASO TIRZs DEPRIVE LOCAL GOVERNMENTS OF REVENUE AND RAISE TAXES

The original purpose of TIRZs was to incentivize development in blighted urban areas. In fact, the first sentence on the City’s “Redevelopment & TIRZ” webpage states: “The Redevelopment Division for the City of El Paso promotes efforts that eliminate urban blight, by promoting infill development, redevelopment, rehabilitation and historic preservation.”

The City of El Paso has created 14 TIRZs, most of which lie far away from areas of urban blight.

According to the City, these 14 TIRZs produce $2,750,000 in revenue and maintain a current balance of $4,490,000. Those are funds that would normally go into City coffers in the form of tax revenue but are instead “reinvested” in the infrastructure of their respective areas.

Until recently, elite local developers easily bought our City representatives with a few thousand dollars of campaign donations and other goodies. In return, the representatives voted to establish TIRZs in open space, enabling these investors to redirect their taxable revenue into their private development projects.

TIRZ13 is the largest TIRZ ever created in El Paso and lies at the top center of the map above. The vast open space there will be developed by Paul Foster and his business partner, who will receive an enormous discount on their City property tax for 50 years that is worth hundreds of millions of dollars.

You and I are the chumps who pay 100% of our property tax every year.

But certain developers get to “reinvest” a significant portion of their tax burden into their own properties while doing nothing to address urban blight.

This salient fact is completely lost on our local media, which report the benefits of TIRZs without providing any critical perspective.

Ultimately, it is the taxpayers at large who have to pay higher taxes in order to replace much of the uncollected revenue, even as we are told by City authorities that TIRZs are beneficial and provide jobs, etc.

Recognizing the abuse, the newer representatives on City Council have begun to curtail and eliminate TIRZs that are a burden to the taxpayers, including TIRZ10A.

Our State Delegation should be working to eliminate TIRZs in open space but have so far refused to act.

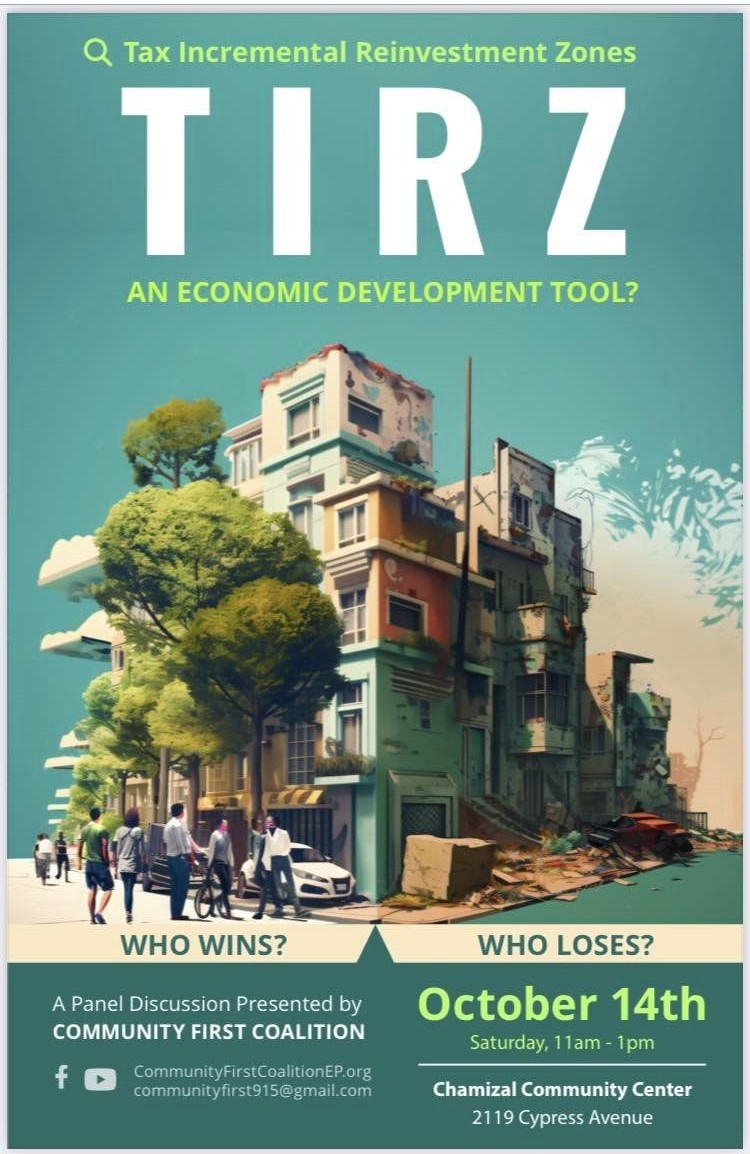

TIRZ PANEL DISCUSSION TO BE HOSTED ON OCTOBER 14

On October 14, the Community First Coalition will host a panel discussion on TIRZs at the Chamizal Community Center at 2119 Cypress Avenue from 11:00am to 1:00pm.

We do not know who will be invited speak and what credentials they will have, but we encourage everyone to attend.