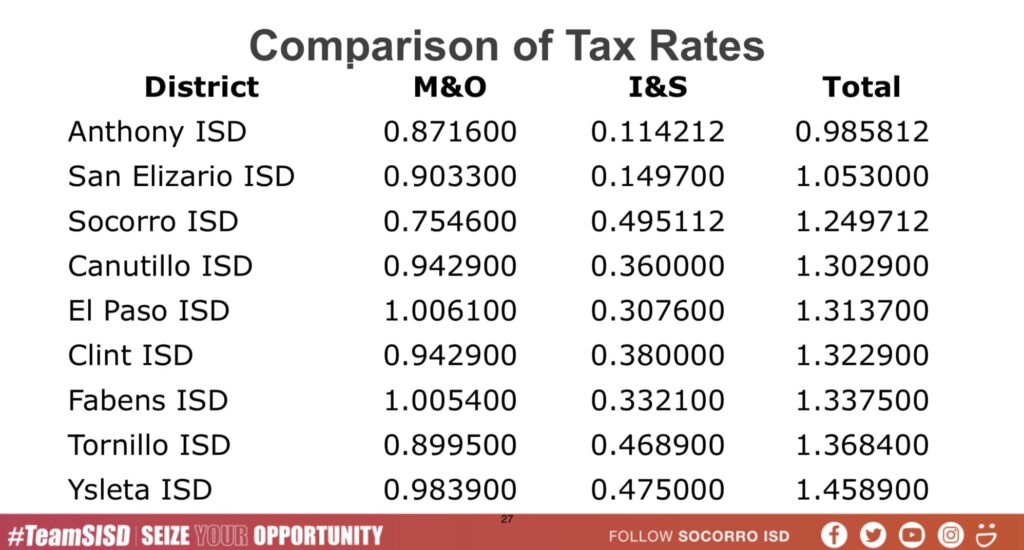

The Socorro Independent School District recently posted the attached chart on their webpage showing the tax rates for the nine school districts in El Paso County.

If you reside within the El Paso Independent School District as we do, your school district tax is the most expensive portion of your property tax bill, accounting for 44.4% of your total burden. As you can calculate from the chart, 76.6% of this tax is for maintenance and operations (M&O) and 23.4% for servicing bond debt (I&S).

By comparison, you pay 29.1% of your property tax to the City of El Paso, 14.4% to El Paso County, 7.9% to University Medical Center, and 4.1% to El Paso Community College.

Let us set aside the question of whether EPISD is providing a high-quality education to our children for the money we invest.

What we are wondering today is why there are nine school districts in El Paso County, which has only 870,000 inhabitants. Los Angeles Unified School District, for example, covers an area occupied by 4.7 million residents with a single school administration.

So why is our community paying for nine separate districts with nine superintendents, nine administrations, and nine headquarters?

Wouldn’t it be more efficient to consolidate the nine districts into three districts, or even one single district?

The savings could then be used to improve teacher pay, and whatever is left over could be returned to the taxpayers in the form of a lower tax rate.

Perhaps our idea is overly simplistic, but I wanted to put it out there for discussion and feedback.